Underwriting criteria: Lenders established their own individual eligibility requirements for borrowing which happen to be generally far more restrictive than federal loans.

This private loan calculator will help you decide the regular payments on a loan. To find out your believed monthly payments and complete fascination you'll spend, just enter the loan volume, loan time period and interest amount in the fields under and click on determine.

The calculator will take these variables under consideration when deciding the real once-a-year percentage level, or APR to the loan. Working with this APR for loan comparisons is almost certainly being far more precise.

On the other hand, this doesn't impact our evaluations. Our viewpoints are our very own. Here is a summary of our partners and here's how we make money.

this article might consist of references to goods from our associates. Here's a proof for the way we generate income

A personal loan gives you funds to employ for a range of authorized expenditures. Right after a quick software and acceptance method, you will get the money in a lump sum.

Household fairness is definitely the part of your property you’ve paid off. You may use it to borrow for other money ambitions.

When you’re comfy Together with the phrases within your $five,000 own loan, you are able to signal and return the paperwork. With on the internet lenders, this whole process usually requires spot inside a user-pleasant electronic format.

From there, it’s your choice to handle the repayment process as promised. Some lenders may well offer you a reduction if you build automatic payments. Autopay could also allow you to steer clear of late payments which have the prospective to harm your credit rating and cost you extra cash in late fees.

Editorial Note: Intuit Credit score Karma receives compensation from third-celebration advertisers, but that doesn’t impact our editors’ opinions. Our third-get together advertisers don’t evaluation, approve or endorse our editorial content.

Financial debt-to-money (DTI) ratio: Your DTI ratio can be a percentage of the amount of of one's gross regular revenue goes towards financial debt on a monthly click here basis. A large DTI can indicate to your lender that you simply’re overextended economically and may’t afford to take on supplemental financial debt.

Right before selecting a lender, Look at the curiosity fees, phrases and options that each lender features. Several lenders provde the option to prequalify, which lets you see the predicted premiums you can qualify for devoid of impacting your credit.

Lifetime insurance plan doesn’t should be complicated. Find peace of mind and pick the correct policy for you personally.

Cost savings account guideBest financial savings accountsBest superior-produce financial savings accountsSavings accounts alternativesSavings calculator

Devin Ratray Then & Now!

Devin Ratray Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Kenan Thompson Then & Now!

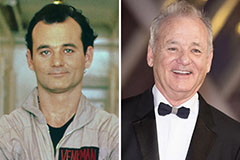

Kenan Thompson Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!